Credit scores are a vital component of modern financial systems, influencing a wide array of financial decisions that impact long-term financial health. From securing loans and obtaining favorable interest rates to determining insurance premiums and even job opportunities, your credit score serves as a critical measure of your financial trustworthiness. Understanding the factors that shape your credit score and how to optimize it can lead to better financial outcomes and greater peace of mind.

In this article, we will explore the essentials of credit scoring, discuss actionable strategies to improve your credit rating, and examine how maintaining a strong credit score contributes to long-term financial stability. By delving into practical examples and relevant data, this comprehensive guide will provide you with the knowledge necessary to make informed decisions about your credit.

What is a Credit Score and Why Does It Matter?

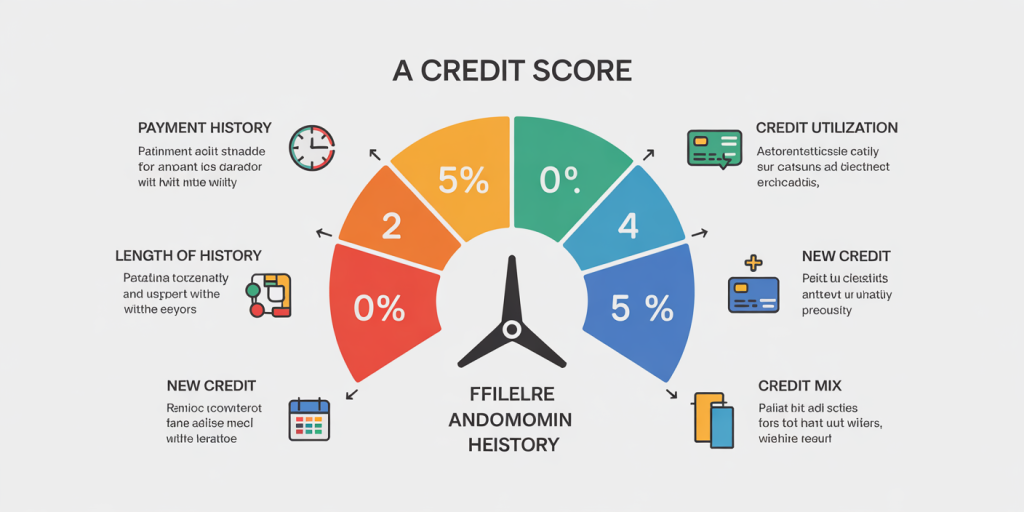

A credit score is a numerical representation of your creditworthiness, typically ranging from 300 to 850, based on your credit history and financial behavior. Major credit reporting agencies such as Experian, TransUnion, and Equifax compile your financial data to generate this score. The most widely used model is the FICO score, which analyzes five critical factors: payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%), and credit mix (10%).

For example, a person with a credit score above 750 is generally considered an excellent borrower and can qualify for lower interest rates on mortgages, car loans, and credit cards. In contrast, a score below 600 often results in higher interest rates or loan denials, which can significantly increase the cost of borrowing.

The significance of a credit score extends beyond loans. Almost 90% of top lenders use credit scores as a substantial factor in decision-making (Consumer Financial Protection Bureau, 2022). Moreover, landlords and utility companies often check credit scores to assess reliability, and some employers use them as part of background checks. Consequently, maintaining a strong credit score is essential for financial flexibility and long-term security.

Key Factors Influencing Your Credit Score

Understanding the components that impact your credit score helps you focus on the right areas for improvement. Payment history is the most significant factor, accounting for 35% of your overall score. This means timely payments on credit cards, loans, and other bills have the most immediate and substantial effect.

For instance, missing a mortgage payment by even a few days can result in a drop of 50 to 100 points in your credit score, depending on your previous score and credit history length. Consistency in payments builds a positive credit profile, while late payments, defaults, or collections harm your rating.

Another major factor is your credit utilization ratio—the percentage of your available credit that you are using. Ideally, keeping this ratio below 30% is recommended. For example, if your total credit limit across all cards is $10,000, using no more than $3,000 at any time is optimal. Higher utilization rates signal increased risk to lenders and can lower your score.

The length of your credit history also plays a role. Individuals with a longer history of responsible credit use tend to have higher scores. Opening multiple new credit accounts in a short period signals risk and typically results in a score decrease. Similarly, a diverse credit mix—such as having credit cards, mortgages, auto loans, and retail accounts—can improve your score by demonstrating the ability to manage different types of credit.

Comparative Table: Impact of Credit Factors on FICO Score

| Credit Factor | Weight in Score (%) | Examples |

|---|---|---|

| Payment History | 35 | On-time payments, missed bills |

| Credit Utilization | 30 | Current balance vs. credit limit |

| Length of Credit History | 15 | Age of oldest account, average account age |

| New Credit | 10 | Recent credit inquiries and account openings |

| Credit Mix | 10 | Combination of credit card, loans, mortgages |

Practical Strategies to Improve Your Credit Score

Improving your credit score requires a strategic and patient approach. Start by focusing on timely payments. Automating your bill payments or setting up reminder alerts can help avoid missed payments—a leading cause of credit score decline. According to Experian (2023), even one late payment can drop your credit score by 60-110 points depending on your prior history.

Reducing your credit utilization is another straightforward strategy. Paying down existing balances or spreading transactions across multiple cards can effectively lower your utilization ratio. For example, if you carry a $2,000 balance on a card with a $5,000 limit (40% utilization), transferring some balance to another card or paying it down to $1,200 can reduce utilization to 24%, typically resulting in a positive impact on your credit score.

Correcting errors on your credit report is often an overlooked method of improving your score. Credit reports can sometimes contain inaccuracies such as outdated information, incorrect balances, or misreported late payments. Regularly obtaining and reviewing your reports from the three major bureaus is essential. Disputing errors can lead to score increases of 20 to 100 points depending on the severity of inaccuracies (Federal Trade Commission, 2023).

Lastly, avoid opening multiple new credit accounts in a short time, as each inquiry can reduce your score by about 5 points. Instead, apply for new credit only when necessary and focus on holding existing accounts open to lengthen your credit history.

Long-term Benefits of a Healthy Credit Score

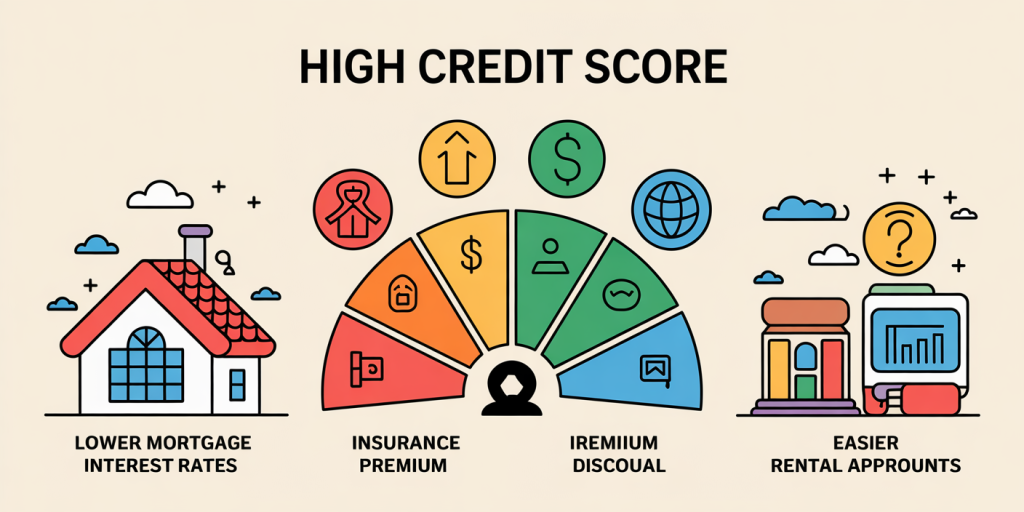

Maintaining a high credit score pays dividends over a lifetime, significantly reducing the cost of borrowing. According to a 2023 Bankrate study, borrowers with excellent credit scores (780+) pay 2-3% less on mortgage interest rates than those with fair credit (620-679). On a $300,000 mortgage over 30 years, this translates into savings exceeding $40,000.

Moreover, a strong credit score expands access to various financial products and services with better terms. Qualified individuals are more likely to receive pre-approved credit card offers with rewards, low fees, and higher limits—enabling greater financial flexibility.

Insurance companies also rely on credit-based insurance scores. Good credit scores can result in premium discounts of up to 20%, making insurance coverage significantly more affordable (Insurance Information Institute, 2022). Even renting an apartment becomes easier with higher credit scores, as landlords are more likely to accept tenants who demonstrate responsible credit behavior.

Common Credit Score Myths Debunked

Numerous misconceptions surround credit scores, often leading to harmful financial decisions. One common myth is that checking your own credit score will lower it. In reality, when you check your credit (known as a soft inquiry), it does not affect your score. Only hard inquiries made by lenders during loan or credit applications impact your score, usually by a few points.

Another myth is that carrying a balance on your credit card improves your score. On the contrary, carrying high balances relative to your credit limit can harm your score due to increased credit utilization. Paying off your balances in full each month is the best practice for optimal credit health.

Some believe paying off old debts or accounts in collections always improves credit scores immediately. While resolving outstanding debts eventually helps, some paid collections remain on credit reports for up to seven years, although newer credit scoring models tend to ignore paid collections.

Future Outlook: Credit Scores in a Changing Financial Landscape

The evolution of credit scoring models continues as lenders seek more inclusive and accurate ways to assess credit risk. Traditional credit scoring has often excluded individuals with limited credit histories, known as “credit invisibles.” Emerging scoring models such as VantageScore 4.0 and FICO XD incorporate alternative data like utility payments, rent, and even phone bills to provide a fuller picture of consumer behavior.

In the next decade, integrating machine learning and big data analytics into credit scoring is expected to enhance prediction accuracy while reducing bias. Regulators are also emphasizing transparency and fairness in credit scoring to ensure that marginalized populations are not disproportionately disadvantaged.

Consumers are encouraged to prepare by monitoring their credit reports regularly, diversifying credit use responsibly, and engaging with new forms of credit data where available. The increasing accessibility of free credit monitoring tools empowers individuals to take control proactively.

Digital wallet services and decentralized finance (DeFi) platforms may also influence traditional credit systems by providing alternative methods for evaluating financial trust. These innovations could reform how credit scores are calculated and used, promoting greater financial inclusion globally.

By understanding the fundamentals of credit scores and implementing proven strategies to optimize them, individuals can achieve improved financial health, reduce borrowing costs, and unlock diverse financial opportunities. Maintaining a strong credit profile is a dynamic process that requires attention, education, and discipline but offers long-term benefits that vastly outweigh the efforts involved. Planning for future changes in credit assessment methodologies will also ensure you remain ahead in the evolving financial environment.